New ESG Reporting Guidelines for China's Stock Exchanges

New ESG Reporting Guidelines for China's Stock Exchanges

On April 12, 2024, China’s three major stock markets, the Shenzhen Stock Exchange (SZSE), the Shanghai Stock Exchange (SSE), and the Beijing Stock Exchange (BSE), issued their respective Guidelines on Self-Regulation of Listed Companies - Sustainability Report (Trial) (collectively, “Sustainability Report Guidelines”).

The Sustainability Report Guidelines, effective on May 1, 2024, are a milestone as they mandate the first-ever disclosure requirements for listed companies about information related to environmental, social, and governance (“ESG”) issues, two years after the China Securities Regulatory Commission (“CSRC”) stated in 2022 its intention to establish corporate sustainability disclosure requirements to support the sustainable development of listed companies.

This article aims to introduce the scope of disclosure in the Sustainability Report Guidelines, highlight certain reporting requirements, and set out their implications for foreign investors.

Scope of Disclosure

As mentioned in our previous article, ESG in China - Opportunities and Challenges for Foreign Investors, much of the emphasis on ESG in China has been placed on ESG disclosure in recent years, and stock exchanges in China have been particularly active in developing an ESG disclosure regime in this regard.

Prior to the promulgation of the Sustainability Report Guidelines, China only imposed compulsory ESG disclosure obligations on certain companies, typically “dirty” manufacturing companies and those that had previously violated environmental or labor regulations. For other companies, ESG disclosure is generally on a voluntary basis.

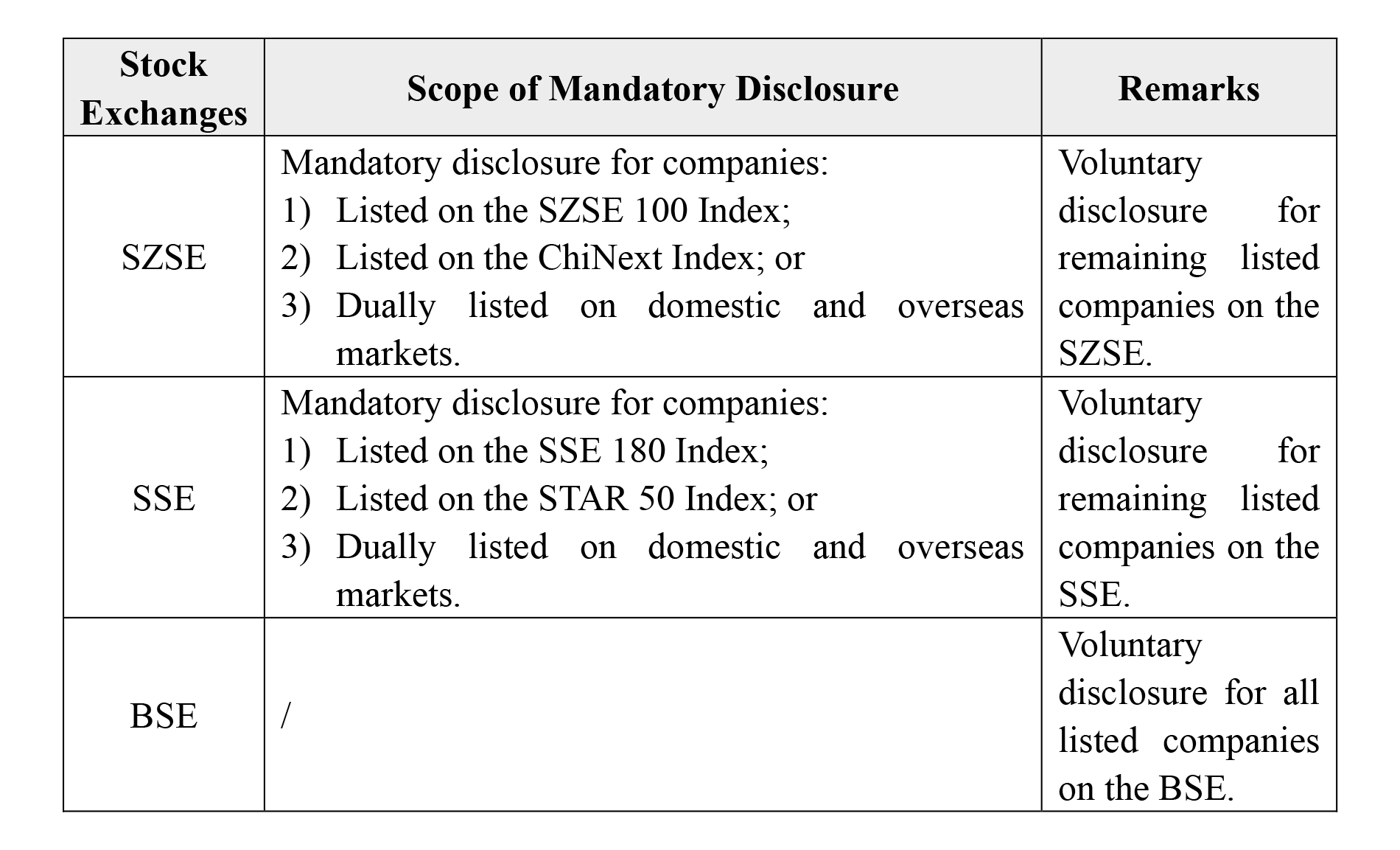

The Sustainability Report Guidelines, however, impose clear and mandatory disclosure requirements for specific listed companies. The scope of mandatory disclosures of different stock exchanges is listed in detail in the table below:

It is noteworthy that, in contrast with the SZSE and the SSE, the BSE has decided to only require voluntary disclosure for its listed companies. This may be due to the fact that the BSE primarily targets small and medium-sized enterprises, which are generally still at the stage of development and may have limited disclosure capabilities.

Overall, although only approximately 500 companies fall within the scope of mandatory disclosure under the Sustainability Report Guidelines, the new requirements help further standardize the ESG reporting practices among Chinese companies, which will better inform foreign investors of the actions taken by companies to address and manage the impacts, risks, and opportunities related to sustainable development.

Highlights of Reporting Requirements

An overarching principle of the Sustainability Report Guidelines is the double materiality approach (“Double Materiality Principle”) on sustainability disclosure topics. The Double Materiality Principle requires regulated companies to identify whether each topic is expected to have a major impact on their business model, operations, development strategy, financial position, operating results, cash flows, financing methods, and costs over the short, medium, and long term (financial materiality) and whether a company’s performance in related issues has a material impact on the economy, society, and environment (impact materiality).

Specifically, under the Sustainability Report Guidelines, regulated companies will be obliged to disclose information across a myriad of ESG-related issues, including climate change (Articles 21 - 28), environmental compliance management (Article 33), data security and customer privacy protection (Article 48), anti-commercial bribery and anti-corruption (Article 55), anti-unfair competition (Article 56), etc. This article will highlight some of these issues below.

Climate Change

In recent years, China has been actively addressing climate change issues and making significant progress in meeting its national strategy of the “Dual Carbon” goal in 2020, which aims to peak carbon emissions before 2030 and achieve carbon neutrality by 2060.

In particular, there has been increasing regulatory attention to carbon trading in China. The Interim Regulations on Administration of Carbon Emissions Trading (《碳排放权交易管理(lǐ)暂行条例》) promulgated by the State Council and coming into force this May set out the general regulatory legal framework over carbon emissions allowance in the carbon trading market in China.

Local governments have also been active in developing the carbon trading regime by releasing local policies and regulations. For example, in August 2023, the Department of Ecology and Environment of Guangdong Province released the Implementation Plan of Guangdong Emissions Trading to Support Peaking Carbon Emissions and Achieving Carbon Neutrality (2023-2030) (《广东省碳交易支持碳达峰碳中和实施方案(2023-2030年)》), which aims to effectively give full play to the role of the carbon trading market in Guangdong Province.

The Sustainability Report Guidelines further specify the required disclosure items for listed companies that participate in carbon trading. For example, Article 24 encourages entities to entrust third-party agencies to disclose and verify the company’s greenhouse gas (GHG) emissions data, as well as other related data. In addition, if the relevant entity participates in carbon trading, it shall disclose whether such trading has been settled within the reporting period and whether any rectification or investigation imposed by the relevant regulatory authorities is involved.

Data Security and Customer Privacy Protection

In recent years, China has introduced several landmark data protection laws and regulations to establish a comprehensive regulatory framework for data security and data protection.

The importance of sound data security and privacy policies for enterprises is further emphasized in recent ESG-specific legislation. Notably, Article 48 of the Sustainability Report Guidelines stipulates that the relevant entity shall disclose the basic information of data security and customer privacy protection during the reporting period, including but not limited to:

(1)establishment and operation of the data security management system, as well as specific measures and certification obtained (if any);

(2)details of the data security incidents that occurred during the reporting period, including the impacts, the amounts involved, the corrective measures taken, and the corresponding effects (if any);

(3)information on the construction and operation of the customer privacy protection system; and

(4)details of events related to the leakage of the privacy of the customers that occurred during the reporting period, including the impacts, the amount involved, the corrective measures taken, and the corresponding effects (if any).

The Sustainability Report Guidelines further demonstrate that data security and privacy protection are essential aspects of corporate sustainability and an integral part of ESG disclosures. Given the nature of the data-driven business of many companies nowadays, companies need to be more aware than ever of the need to strictly follow and comply with privacy laws and standards in China to avoid any breach of data protection laws and corresponding penalties by Chinese regulatory authorities.

Anti-Unfair Competition

It is a worldwide issue that companies may exaggerate their ESG performance and contribution through incomplete or fabricated ESG disclosures by, for example, engaging in “greenwashing” to attract investors. Greenwashing is banned in many jurisdictions to better protect investors and consumers.

China has not enacted a specialized law to regulate greenwashing, but it regulates such misconduct through specific bodies of laws, including the Advertising Law (《广告法》), the Anti-Unfair Competition Law (《反不正当竞争法》), the Law on the Protection of Rights and Interests of Consumers (《消费者权益保护法》), etc.

Article 56 of the Sustainability Report Guidelines stipulates that the regulated entity shall disclose the specific information of its anti-unfair competition work during the reporting period, including but not limited to the specific measures for preventing unfair competition (such as false advertising, monopolies, trade secret infringements, etc.).

The requirements under the Sustainability Report Guidelines add another layer of protection for investors by requiring companies to disclose ESG-related information objectively and truthfully and by emphasizing that the companies shall not disclose information relating to sustainable development selectively, and shall not mislead investors and other interested parties, no matter whether such disclosures are mandated or voluntary.

Concluding Remarks

In sum, as an effort to join other major markets in moving towards greater transparency and mandatory sustainability reporting requirements for companies, the Chinese government is expected to take further strides towards strengthening environmental regulations, addressing social issues, and improving corporate governance by imposing compulsory ESG disclosure requirements on a larger scope of companies.

As stipulated in the revised Company Law (《公司法》), which is to take effect from this July, companies shall take into full consideration the interests of their employees, consumers, and other stakeholders, as well as social and public interests, including the protection of the environment, and shall assume social responsibilities when engaging in business operations. The revised Company Law clearly marks a pioneering effort in establishing ESG-related obligations for all companies, even though the requirements are only high-level at this stage.

As we are still expecting further implementation rules to be promulgated to provide further guidance for companies in this regard, it is crucial for foreign investors to keep an eye on the Chinese markets to stay up-to-date on the country’s ESG disclosure requirements, as well as other recognized international standards, such as the International Financial Reporting Standards (“IFRS”) and the Sustainability Disclosure Standards developed by the International Sustainability Standards Board (“ISSB”), which, although not explicitly referred to in the Sustainability Report Guidelines, pose substantial impacts on the measurements and methods ultimately adopted therein.